What Comprehensive Auto Insurance Covers

by Piyasa Mukhopadhyay Blog 12 September 2025

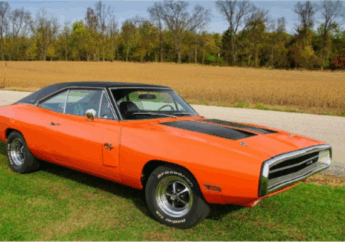

Imagine your car damaged not by a crash, but by something completely unexpected – a falling tree, a sudden hailstorm, or even theft. These non-collision incidents can be just as costly as an accident, and they’re precisely what comprehensive auto insurance is designed to cover.

Many drivers understand liability and collision coverage, but comprehensive insurance often remains a mystery. We’re here to explain it. In this guide, we’ll explain precisely what comprehensive auto insurance is, the specific events it protects you from, how it differs from collision coverage, and most importantly, how to decide if it fits your vehicle and budget.

We aim to provide you with clear, actionable information so that you can confidently protect your automotive investment. A detailed, comprehensive auto insurance guide can offer further insights into finding the right coverage for your needs.

Often called “other than collision” coverage, comprehensive insurance is designed to pay for repairs or replacement of your vehicle if it’s damaged by an event that is not a collision. It protects your car from many unpredictable incidents, often outside your control as a driver. This type of coverage is distinct from liability insurance, which covers damages you cause to others, and collision insurance, which handles damages from accidents involving your vehicle hitting another object or car. Understanding these distinctions is crucial for building a robust auto insurance policy.

Specific Events Covered by Comprehensive Insurance

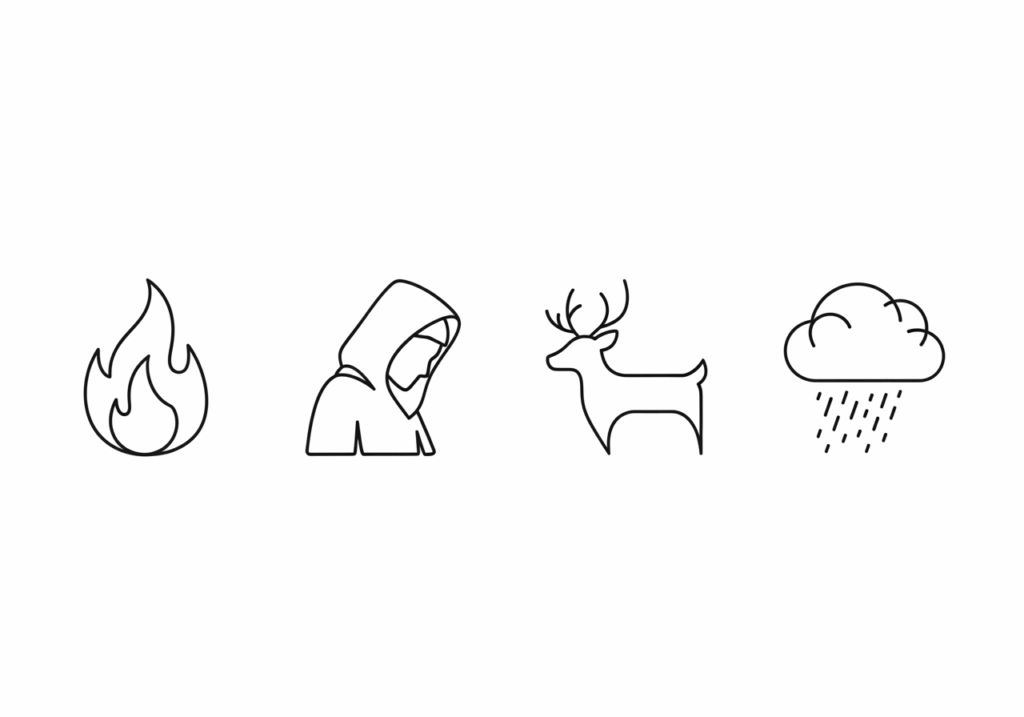

While policies vary, comprehensive coverage typically pays for damage from a broad spectrum of non-collision events. These are often unforeseen circumstances that can cause significant financial loss to a vehicle owner. Here’s a breakdown of the common perils covered:

- Theft and Vandalism: One of the most common reasons drivers opt for comprehensive coverage is protection against theft. Comprehensive insurance can cover its actual cash value (ACV) after your deductible if your car is stolen. This also extends to attempted theft or vandalism, such as a broken window, slashed tires, or graffiti. The financial burden of replacing a stolen vehicle or repairing malicious damage can be substantial, making this a vital aspect of comprehensive protection. For more on what comprehensive insurance covers, you can refer to resources from the Insurance Information Institute.

- Fire and Explosions: Comprehensive insurance can cover damage caused by mechanical issues, such as an engine fire, an electrical short, or an external fire (like a garage fire spreading to your car). This extends to damage caused by explosions, which, while less common, can be devastating.

- Weather and Natural Disasters: Vehicles are vulnerable to various natural phenomena. Comprehensive coverage often includes:

- Hail: Damage from hailstones, ranging from minor dents to shattered windows.

- Windstorms: Damage caused by strong winds, such as falling debris or your car being blown into an object.

- Floods: If your car is damaged by rising water, whether from heavy rains, overflowing rivers, or storm surges.

- Hurricanes and Tornadoes: These severe weather events can cause widespread damage, including impacts from flying objects, water damage, and structural damage to your vehicle.

- Earthquakes: While less common in some regions, earthquake damage to a vehicle is typically covered by comprehensive insurance.

- Falling Objects: Imagine a tree branch falling on your parked car during a storm, or debris from a construction site landing on it. Comprehensive insurance steps in to cover the repair costs for such incidents. This also includes objects that fall onto your car, rather than your car hitting them.

- Animal Collisions: A surprisingly common and often costly event is hitting an animal, especially a deer. Unlike hitting another car or a stationary object, which falls under collision coverage, striking an animal is typically covered by comprehensive insurance. This distinction is essential, as the damage can range from minor dents to severe structural damage, and even total loss of the vehicle. For specific details on this, you might find it helpful to consult information on topics like Does Hitting a Deer Fall Under Collision Coverage?

- Civil Disturbances: In rare but impactful situations, your vehicle might be damaged during a riot, protest, or other civil commotion. Comprehensive coverage can protect against damages such as broken windows, fire, or vandalism during such events.

What Isn’t Covered by Comprehensive Insurance

It’s just as important to understand what comprehensive insurance does not cover. These damages typically fall under other parts of your auto policy or are excluded entirely. Knowing these limitations helps prevent surprises and ensures you have the right mix of coverages for your needs.

- Collision Damage: The most significant exclusion from comprehensive coverage is damage resulting from a collision. If your vehicle hits another car, a tree, a guardrail, or rolls over, the repairs are covered by your collision insurance, not comprehensive. This is a fundamental distinction between the two types of coverage.

- Pothole Damage: While it might feel like an “other than collision” event, hitting a pothole is generally considered a collision with a road hazard. Therefore, any damage sustained from a pothole (e.g., bent rims, tire damage, suspension issues) would be covered by collision insurance, which is not comprehensive. The Insurance Information Institute provides further clarification on this common inquiry.

- Mechanical Failure: Comprehensive insurance is designed for external, unforeseen events, not internal vehicle issues. Engine trouble, transmission failure, brake problems, or any other mechanical breakdown due to wear and tear or manufacturing defects are not covered. These repairs typically fall under your vehicle’s warranty or are your responsibility as the owner.

- Normal Wear and Tear: Over time, all vehicles experience depreciation and wear and tear. This includes rust, fading paint, worn tires, or general deterioration due to age and use. Comprehensive insurance does not cover these routine maintenance needs or the natural aging process of your vehicle.

- Personal Belongings: While comprehensive insurance covers damage to your vehicle, it generally does not cover personal items stolen from inside your car. This includes laptops, phones, luggage, or other valuables. These items are typically covered under your homeowners’ or renters’ insurance policy, subject to their respective deductibles and coverage limits. It’s wise to check your home or renters policy to understand this coverage.

- Bodily Injury or Property Damage to Others: Comprehensive insurance solely focuses on damage to your vehicle. It does not cover medical expenses for injuries you or others sustain in an accident or damage your vehicle causes to other people’s property. That’s the role of liability insurance, a mandatory component of auto insurance in most states.

Comprehensive vs. Collision: Understanding the Difference

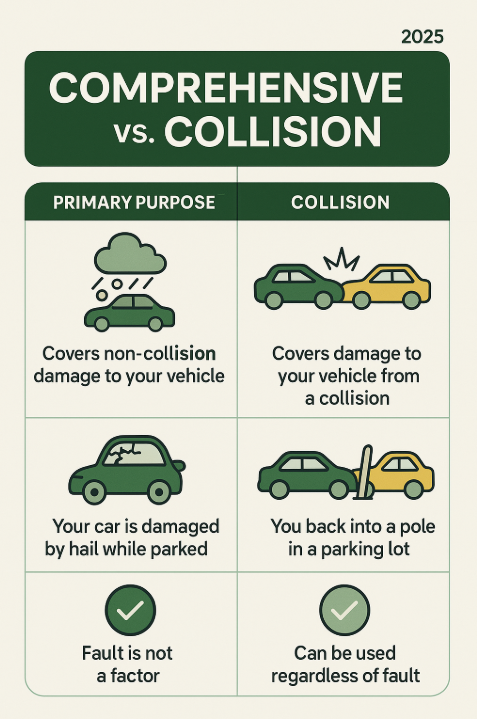

Drivers often confuse comprehensive and collision coverage, but they protect against entirely different types of risk. Both cover damage to your vehicle, but the cause of that damage is the key distinction. While both are crucial for protecting your investment, their roles are distinct. Understanding this difference is paramount when building an effective auto insurance policy.

Feature: Comprehensive Insurance Collision Insurance Primary Purpose: Covers non-collision damage to your vehicle. Covers damage to your vehicle from a collision. Typical Scenario: Your car is damaged by hail while parked. You back into a pole in a parking lot. Fault Consideration: Fault is not a factor. It can be used regardless of who is at fault. Example Events: Theft, fire, flood, animal impact, vandalism. Hitting another car, a tree, or a guardrail. To elaborate, collision insurance covers damage to your vehicle when it collides with another vehicle or object. This includes scenarios like hitting a parked car, a fence, a tree, or rolling over. It pays for your vehicle’s repairs regardless of who was at fault in the accident. For instance, if you swerve to avoid an animal and hit a telephone pole, collision coverage would typically pay for the damage to your car.

On the other hand, comprehensive insurance covers events that are generally out of your control and unrelated to a driving accident. This includes the incidents we detailed earlier: theft, vandalism, fire, natural disasters, and animal collisions. Comprehensive coverage would apply if your car is damaged by a severe hailstorm while parked in your driveway. The key takeaway is that collision insurance involves your vehicle colliding with something, while comprehensive insurance covers almost everything that could damage your car. You can explore resources like Collision vs. Comprehensive for a more detailed comparison.

How They Work Together in “Full Coverage”

The term “full coverage” isn’t an official type of policy. It’s a common phrase to describe a combination of coverages offering broad protection: liability, collision, and comprehensive. While liability insurance is required by law in nearly every state to cover damages you cause to others, collision and comprehensive are optional coverages that protect your own vehicle. Together, they form a robust safety net for your automotive investment.

When people talk about “full coverage,” they’re typically referring to a policy that includes:

- Liability Coverage: This is the foundation of any auto insurance policy. It pays for damages and injuries you cause to others in an accident. Most states mandate minimum levels of liability coverage. You can find state-specific requirements from the Insurance Information Institute.

- Collision Coverage: As discussed, this covers damage to your own vehicle caused by an accident in which you collide with another object or vehicle.

- Comprehensive Coverage: As detailed in the previous section, this protects your vehicle from non-collision damages.

Combined, these three components offer extensive protection for both your financial responsibility to others and the physical integrity of your vehicle. While liability insurance is a legal necessity, adding collision and comprehensive coverage provides peace of mind, especially for newer or more valuable vehicles. For a deeper understanding of this combination, you might find information on Full Coverage vs. Comprehensive and Collision to be helpful.

The Financials of Auto Comprehensive Insurance

Understanding the costs and payouts associated with comprehensive coverage is key to deciding whether it’s right for you. The main components are your deductible, your premium, and your vehicle’s value. These elements interact to determine your out-of-pocket costs and the extent of your coverage.

How Deductibles Work with Comprehensive Claims

A deductible is the amount you agree to pay out-of-pocket for a covered claim before your insurance company begins to pay. You choose your deductible amount for comprehensive insurance when you buy the policy. Common choices are $500 or $1,000, though some insurers may offer options as low as $100 or as high as $2,500. The deductible serves as a shared responsibility between you and your insurer.

The relationship between your deductible and your premium is inverse:

- Higher Deductible: Choosing a higher deductible (e.g., $1,000 or more) means paying more out of pocket if you file a claim. In return, your insurance company will charge you a lower monthly or annual premium. This option is often preferred by those with emergency savings who are willing to take on more risk for lower recurring costs.

- Lower Deductible: Opting for a lower deductible (e.g., $250 or $500) means paying less out of pocket when you file a claim. However, this convenience comes at the cost of a higher monthly or annual premium. This is often a good choice for those who prefer predictable, lower out-of-pocket expenses in the event of an incident.

For example, if your car sustains $3,000 in hail damage and you have a $500 comprehensive deductible, you would be responsible for paying the first $500 to the repair shop. Your insurer would then cover the remaining $2,500. If your deductible were $1,000 for the same damage, you’d pay $1,000, and the insurer would pay $2,000. Selecting a deductible amount that you can comfortably afford to pay at any given time is crucial, as you’ll need those funds readily available if you file a claim.

Factors That Influence Your Premium

Comprehensive auto insurance is generally quite affordable, especially compared to collision coverage. Comprehensive coverage costs around $12 monthly in the U.S., translating to approximately $134 per year on average. However, this can rise to nearly double that depending on various factors. For comparison, collision coverage costs an average of $290 a year. Several key elements determine your specific comprehensive premium:

- Vehicle Make, Model, and Age: The type of car you drive significantly impacts your premium. More expensive vehicles, luxury cars, or newer models generally cost more to repair or replace, leading to higher comprehensive premiums. Cars statistically more prone to theft also tend to have higher rates. Conversely, older, less valuable vehicles often have lower comprehensive premiums, though at some point, the premium may outweigh the car’s value.

- Your Location: Where you live and primarily park your car plays a significant role. Rates are higher in areas with:

- High Theft Rates: Urban areas or regions known for vehicle theft will see increased comprehensive premiums.

- High Vandalism Rates: Similar to theft, areas with frequent vandalism reports will have higher costs.

- Severe Weather Events: Regions prone to hailstorms, floods, hurricanes, or wildfires will naturally have higher comprehensive rates due to increased risk of claims. For instance, the most expensive state to insure a car in is New York, where the average driver spends $1,511 on full car insurance each year, while the least expensive state is North Dakota, where drivers pay just $692 per year on average. These state-level differences highlight the impact of location.

- Your Driving and Claims History: While comprehensive claims are often considered “no-fault” (meaning they don’t count against you in the same way an at-fault accident would), a history of multiple comprehensive claims in a short period could still signal a higher risk to insurers and potentially lead to increased rates. A clean driving record, free of accidents and violations, generally helps lower all your insurance premiums.

- Your Deductible: As previously discussed, the deductible you choose directly influences your premium. A higher deductible will result in a lower premium, and vice versa.

- Other Factors: Insurers also consider your credit score (in most states), your age, gender, marital status, and even your occupation. Bundling policies (e.g., auto and home insurance) with the same provider often leads to discounts, reducing overall insurance costs. The Insurance Information Institute is a valuable resource for more statistics and facts on auto insurance.

Is Comprehensive Coverage a Smart Choice for You?

Deciding whether to carry comprehensive coverage depends on your vehicle’s status, value, and financial situation. While it’s a valuable protection, it’s not always necessary for every driver or every car. Making an informed choice involves weighing the costs against the potential benefits and your personal risk tolerance.

When Comprehensive Insurance is Mandatory

For many drivers, the choice is made for them. If you have a loan on your vehicle or are leasing it, your lender or leasing company will almost certainly require you to carry both comprehensive and collision coverage. This is a standard practice to protect their financial interest in the vehicle until it is fully paid off. Since the lender technically owns a portion of the car until the loan is satisfied, they want to ensure that their asset is protected against all types of damage, not just those from collisions. This requirement typically remains in effect for the entire loan or lease agreement. You can check resources like Progressive’s guide for more details on financed car insurance requirements.

Making the Decision: A Cost-Benefit Analysis

If you own your car outright, purchasing or dropping comprehensive coverage is entirely up to you. This is where a careful cost-benefit analysis becomes essential. Here’s how to weigh the pros and cons to determine if comprehensive coverage is a worthwhile investment for your specific situation:

- Assess Your Vehicle’s Value: This is perhaps the most critical factor. The maximum payout from a comprehensive claim is the vehicle’s Actual Cash Value (ACV) minus your deductible. ACV is what the car was worth right before the damage occurred, considering depreciation, mileage, and condition. You can estimate your car’s ACV using online tools like Kelley Blue Book.

- The potential payout may not justify the ongoing premium cost if your car has a low ACV (e.g., under $3,000). For instance, if your vehicle is worth $2,000 and your deductible is $500, the maximum you’d receive is $1,500. If your annual comprehensive premium is $150, it would take only 10 years for the premiums paid to equal the maximum payout. For older, low-value vehicles, saving the premium money and self-insuring for comprehensive damages often makes more financial sense.

- Apply the “10% Rule”: Some financial experts recommend dropping comprehensive (and collision) coverage if the annual premium is more than 10% of your car’s value. For example, if your car is worth $4,000 and your combined annual comprehensive and collision premium is over $400, it may no longer be cost-effective. This rule provides a quick way to gauge if your insurance costs are disproportionate to your vehicle’s worth.

- Evaluate Your Financial Situation: Could you comfortably afford to repair or replace your car out-of-pocket if it were stolen, totaled by a flood, or severely damaged by a falling tree? If an unexpected repair bill of several thousand dollars would cause significant financial hardship, comprehensive coverage provides essential peace of mind and financial protection. You might consider foregoing the coverage if you have a robust emergency fund that could cover such an expense.

- Consider Your Risk Profile: Your environment and driving habits influence your risk of comprehensive claims:

- Theft Risk: Do you live in an area with high auto theft rates? Do you park your car on the street overnight in a high-crime area?

- Vandalism Risk: Is your neighborhood prone to vandalism?

- Weather Risk: Do you live in a region frequently affected by severe weather, such as hailstorms, hurricanes, or floods?

- Animal Collision Risk: Do you frequently drive on rural roads where animal collisions (especially with deer) are common? A comprehensive policy is particularly beneficial in these higher-risk scenarios. For example, understanding Car Insurance in MA specifics, including local risks, can help if you live in Massachusetts. Similarly, drivers in New Hampshire can consult the New Hampshire Insurance Department for local insights.

- Future Impact on Premiums: While a single comprehensive claim typically has less impact on your future premiums than an at-fault collision, frequent claims can still lead to higher rates or even make it difficult to find coverage.

Navigating these options can be complex. Consulting with an insurance professional can provide personalized advice based on your specific circumstances, helping you determine if comprehensive coverage fits your auto insurance policy. They can help you understand the nuances and make an informed decision according to your circumstances.

Frequently Asked Questions about Comprehensive Auto Insurance

We often encounter common questions about comprehensive auto insurance. Here, we address some of the most frequent inquiries to provide further clarity.

Does comprehensive insurance cover a cracked windshield?

Yes, damage to glass, including a cracked or shattered windshield, is one of the most common types of comprehensive claims. This is a significant benefit, as windshield replacement can be pretty costly. Many insurance policies even offer a separate, lower deductible (or sometimes a $0 deductible) specifically for glass repair or replacement, making it an affordable fix. Policyholders often appreciate this feature, as minor rock chips or cracks are common occurrences. For instance, Liberty Mutual and Allstate highlight glass coverage as a key component of their comprehensive offerings.

Is comprehensive insurance the same as “full coverage”?

No. “Full coverage” is an informal term typically referring to a policy that includes liability, collision, and comprehensive coverage. Comprehensive insurance is just one critical component of a “full coverage” policy. “Full coverage” isn’t a single policy you can buy; it’s a combination of different types of coverage designed to provide broad protection. You would be exposed to non-collision risks without a comprehensive “full coverage” policy. To understand what “full coverage” entails, it’s always best to discuss the specific components with your insurance provider. You can also review articles that define Comprehensive and Collision Coverage to understand their individual roles within a broader policy.

Will filing a comprehensive claim increase my insurance premium?

Generally, a single comprehensive claim is less likely to raise your rates than an at-fault collision claim. This is because the events covered by comprehensive insurance (like weather damage, theft, or animal collisions) are considered outside the driver’s control. Insurers typically view these incidents as random acts of nature or crime, rather than indicators of risky driving behavior.

However, there are nuances:

- Frequency: While one claim might not impact your premium significantly, filing multiple comprehensive claims in a short period (e.g., several within a year or two) could lead to a premium increase. Insurers might see a pattern of claims, even if not at-fault, as an increased risk.

- Severity: Extremely high-cost comprehensive claims, such as a total loss due to a natural disaster, might also have a slightly larger impact than minor claims.

- Insurer Policies: Each insurance company has its own underwriting guidelines. Some might be more forgiving than others regarding comprehensive claims. Discussing the potential impact of a claim with your agent before filing is always a good idea, especially for minor damages close to your deductible amount.

How can someone obtain or adjust their comprehensive auto insurance coverage?

Obtaining or adjusting comprehensive auto insurance coverage is straightforward. It is typically handled through your insurance agent or directly with your insurance company.

- New Policy: If you’re purchasing a new auto insurance policy, comprehensive coverage will be offered as an optional add-on alongside liability and collision. At this stage, you’ll select your desired deductible.

- Existing Policy: If you already have an auto policy and wish to add comprehensive coverage, contact your current insurer. They can provide a quote to add it to your existing policy, and the change can often be made effective immediately.

- Adjusting Coverage: Contact your agent or insurance company to modify your comprehensive coverage (e.g., changing your deductible). They can walk you through the options and explain how changes to your deductible will affect your premium. A higher deductible will lower your premium, while a lower deductible will increase it.

- Comparison Shopping: It’s always wise to compare quotes from different insurance providers to ensure you get the best rates and coverage for your needs. Online quote tools and local agents can help you shop around efficiently. Resources like Auto Insurance can be a good starting point for general information on auto insurance, including how to obtain it.

Conclusion

Auto comprehensive insurance is a powerful tool for protecting your vehicle from the unexpected. It fills a critical gap by covering various non-collision damages that could otherwise lead to significant financial hardship. From the sudden fury of a hailstorm to the distress of theft or vandalism, comprehensive coverage is a vital safeguard for your automotive investment.

By understanding what it covers, how it works with deductibles, and the factors that influence its cost, you can make a confident and informed decision about its necessity for your specific situation. Evaluating your car’s actual cash value, budget, and personal risk tolerance will help you determine if this essential coverage is the right fit for your auto insurance policy.

While comprehensive car insurance starts at an affordable average of $7 per month, its value in moments of unforeseen crisis can be immeasurable. Protecting your vehicle beyond collisions ensures you’re prepared for whatever the road or nature throws your way. To explore your options and get a personalized quote, consider contacting a qualified insurance professional today. They can help you tailor a policy that provides the peace of mind you deserve.

For more information on protecting your vehicle and to get a personalized quote, visit our Car Insurance page.