A Deep Dive Into Financial Wellness And How It Can Help You In The Long Run

by Subham Kamila Finance Published on: 15 January 2025 Last Updated on: 07 May 2025

We are all financial beings, just corpses that twist and turn with the scent of money. Well, that was a grim of painting a picture, but tis’ the truth. In today’s world, financial wellness is one of the most essential things that you need to have.

Without financial stability and wellness, you cannot go anywhere. We might even go the mile and daresay that without a sense of financial wellness, you are doomed. As a result, we are here to save you guys from the perpetual torment of poverty and unstable finances.

Think of us like Justice League or Avengers of your finances. And it is our job to help you understand the complex concepts of finances that you need in life. Here we go!

What Is Financial Wellness?

To delve deep into understanding what is financial wellness, we need to understand the basics first. So, what is financial wellness? Is it simply about having enough money, or is it something more nuanced?

Well, financial wellness can be explained as a state of economic stability where you can comfortably pay your bills and plan for other financial liabilities as well. These financial liabilities could be loan repayment, saving, investing, etc. Subsequently, keep some funds for a rainy day.

As per the U.S. Consumer Financial Protection Bureau, financial wellness is “the feeling of having financial security and financial freedom of choice, in the present and when considering the future.”

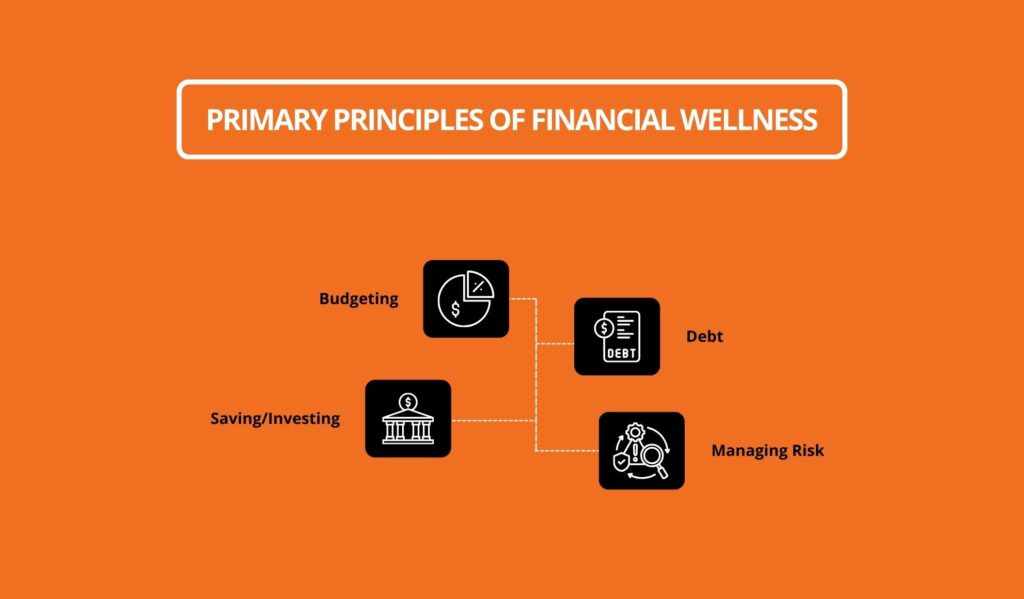

Primary Principles Of Financial Wellness

Financial wellness is not just having enough money or being ‘rich.’ As we have discussed, it is a nuanced concept that involves some elements to make it work. So, financial wellness is basically a system that can help a business, or an individual become financially independent.

Hence, for a better understanding, you must have clarity about the individual pillars that are holding the concepts. This section is primarily about that. Here, we will be looking at four core components of financial wellness.

This will help you understand the concept in all its essence and glory, so to speak. Therefore, here are the four primary pillars of financial wellness. Components that add to the concept’s meaning.

Budgeting

The first part of the concept is the budgeting part of the deal. To achieve a sense of financial wellness, you need to start budgeting yourself. However, budgeting is not depriving yourself of the basics. Things like food, clothing, rent, etc.

Budgeting is all about being conscious of your money. Not letting extra expenses alight your pockets. The best way to proceed is to understand the basic costs you must bear every month or year. Subsequently, setting an upper cap limit on your day-today expenses.

This practice can truly help you achieve a sense of control over your finances, something young adults like us need.

Debt

The second part of the deal is all about managing the debt. As financial creatures, nobody will be truly free from debt. This is a vicious cycle that every middle-class human being needs to accept and work around. YOU WILL NEVER BE FREE FROM FINANCIAL DEBTS!!!

However, you need to learn how to manage them effectively. Debt management is mostly about identifying and isolating the big debts and then repaying them ASAP. Which in turn creates a system. A system where you can invest or start a new debt cycle.

The second part of debt management is keeping the credit score shiny and above 750. This is done with the help of ethical borrowing and good repayment practices. Being timely on your repayment, never missing opiate commitments, and much more.

Saving/Investing

Saving and investing are two different aspects of financial wellness and clarity. However, we decided to list these two under one section as they are similar in their own ways. Saving and investing are like yin and yang.

Saving and investing are essential for retiring early or achieving stability. Savings are when individuals keep aside some money for a myriad of different reasons. It is preferable to save in a savings account.

Meanwhile, investing is using the saved money to invest in something that brings in return. Returns that add to your financial well-being and stability. Hence, saving and investing is crucial for someone who wants to achieve a sense of financial stability.

Managing Risk

Financial experts believe that growing your wealth is the easy part. Spend less, save more, invest accordingly. However, protecting your wealth is the real deal. Wealth protection is absolutely crucial.

This is because financial storms can arrive at any hour, and you need to be prepared to the core to avoid them. Even the most prominent financial magnates have faltered in an economic storm.

Over here, we are calling unprecedented expenses financial storms and problems. As a normal human being, you cannot predict what the future holds. In fact, you can only prepare yourself. Therefore, being prepared for an economic crisis is equally important.

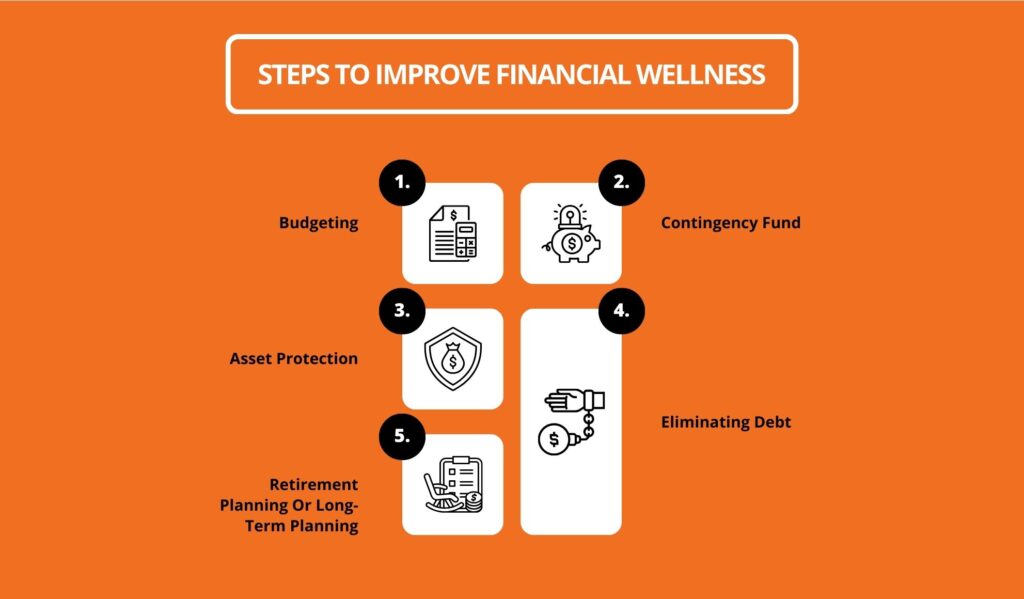

Steps To Improve Financial Wellness

Well, we have already got the fundamentals out of the way. Therefore, now is the time to dive deeper into the rabbit hole and look at means and ways to improve financial wellness. However, we would ask you to temper your expectations beforehand.

Achieving stability in finance is not an easy task. You need to be at it for a long enough time to see results. Hence, never expect to see results in just a month or two. It might take years for signs to show.

Still, you need to be at it. On that note, here are some of the prominent methods of improving financial wellness.

Budgeting

Well, we have already talked about budgeting in an earlier section. Budgeting is one of the most crucial aspects to master if you want to expand your financial reach. Budgeting is a multi-faceted and multi-tiered process that has so many layers.

However, what works best for us is to follow a two-pronged approach. Make a day-to-day budget that looks at the daily expenses and make a monthly budget of all the important costs.

This will help you have some sense of self-control on your finances and save money simultaneously. Two birds with one stone. Still, this is just what works for us. You might approach the topic differently altogether.

Contingency Fund

A contingency fund is the second step towards financial wellness. You never know when a tragedy might strike. However, what you can do is be prepared for it. A contingency fund is just that. In simpler terms, it is just the money set aside for a rainy day.

A contingency fund can help you manage unemployment, health issues, and other financial liabilities. Therefore, it is like a parachute that you can bank on at all times. Hence making it a crucial aspect.

Just make sure that the contingency fund is always accessible so that you can quickly get to it when you need it. Otherwise, it defeats the whole purpose of having a contingency fund.

Asset Protection

The third prominent aspect of financial wellness is asset protection. Asset protection is primarily about safekeeping what you have. A contingency fund is a good parachute, but it will serve you for the short term. You need something more potent.

This is where an asset protection system comes into play. Asset protection looks at long-term solutions to economic crises. Subsequently, it deals with big crises like home foreclosure, a permanent disability that stops an individual from earning, a significant business loss, etc.

Therefore, contingency funds are essential but will not provide as much protection as asset protection planning or protocols. Something that helps mitigate risks and financial crises.

Eliminating Debt

Then comes debt elimination. As we have already hammered in your head, you cannot avoid being in debt. As a product of today’s economic structure, you must be under some form of debt to function.

However, that does not mean you are bound or shackled by it. Debt management and elimination can actually help you in that endeavor. Therefore, get in touch with professionals who can help you in that effort and enable you to eliminate your debt.

Then again, this is a complex process that you need to understand to proceed. Therefore, get your research done before diving headlong into the abyss.

Retirement Planning Or Long-Term Planning

Planning barely for retirement will always pay you nicely in kind. You need to start as early as possible, just so that you can build your retirement funding. Having a retirement plan is again about having a plan and not just money.

A plan that can help you find peace and comfort in your old age. Moreover, starting your retirement journey early will actually help you secure delicious tax rebates and advantages. Hence, stop dilly-dallying.

However, we would also advise against rushing the process. Getting a professional can truly help your case and enable you to do the right thing at the right time and pace.

The Final Thought: How To Bring About Financial Wellness

In summation, financial wellness is a complex concept that demands clarity on multiple fronts. Hopefully, we were able to cover the topic to your satisfaction and helped you along the way. Still, if you have any queries, you can definitely get in touch with us, and we will gladly help you.

Do leave us a comment and share our article if you like it. It will give us the necessary boost and motivation to bring more content to business and wealth management. Thank you, and have a great day ahead.