Knowing The Different Types oF Risk Management Can Actually Save Your Business

by Mashum Mollah Finance 30 October 2024

Think of it like this: you started a business. Things are going great. You are bringing in wads of cash. You continue this cycle for a considerable amount of time, and you branch out.

Suddenly, your company is gripped with financial turmoil. Everything crumbles like a house of cards. Everything was fine, but what went wrong?

Nothing really; you just needed to have a risk management plan with you. A contingency plan that was supposed to come into action as soon as things went awry. However, do not worry anymore as we got you.

This article is all about identifying gaps in your risk management plan and the different types of risk management plans that you need to know about.

Let us dive right in!

What Is A Risk Management Strategy?

A risk management strategy is one of the most important things that your business can have. It is one thing that can save you from going under. This is one of the standing facts about financial management.

But before we can start discussing the nuances of financial forecasting and the role risk management plays, let us understand what risk management truly means. A risk management plan is aimed at dealing with business risks.

Howevevr, risk management often needs to be clarified with crisis management. While both are aimed at saving a company from going under, the methodology differs. Risk management is a precautionary measure. At the same time, crisis management is about dealing with the crisis.

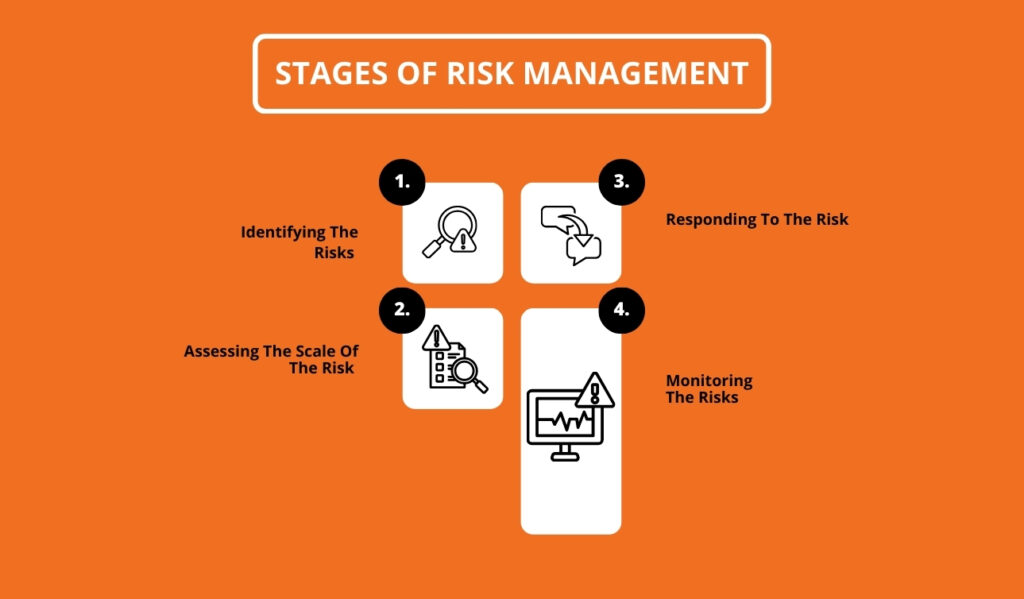

Stages Of Risk Management

Well, risk management is a nuanced process. Therefore, experts decided to break the whole thing into smaller chunks or stages for better understanding. Hence, just having an idea about the overall process without any sense of clarity about the stages is absolutely wrong.

Moreover, you will need more than half-knowledge. Therefore, it is essential to learn about the stages to help you understand the different risk management techniques that are out there.

Lastly, regardless of the existence of the types of risk management, these stages remain mostly the same. Therefore, you need to have this piece of knowledge.

Identifying The Risks

The very initial step of the process is identifying the risk. This is an essential part of the process and needs to be aced. Just remember that everything regarding your crisis management plan and risk management is related to this stage.

Therefore, be very careful and precise when identifying risks. The best way to proceed is to sit with a panel of professional business advisors. People with the necessary skills to identify a risk before it becomes a catastrophe.

Assessing The Scale Of The Risk

Once you are done identifying a risk, you need to start an effort to understand the magnitude of the risk. Risk assessment is an essential skill. Correct assessment of the risk would give you information like the magnitude of the risk and the likely chance of manifesting.

Risk assessment is a very technical part of the process. This stage is riddled with numbers, bell curves, and other statistical pieces of data. Hence, it is better to get this done by a professional. Otherwise, the chances of botching this up increase drastically.

Responding To The Risk

The third part of the process is responding to the risk. You identified the risk, and You know what it could do if left unchecked. What now? Do you just forget it? Well, not really. Now is the time to actually bring in the big guns.

There are several different forms of managing and assessing risks. However, the most crucial action is to contain the risk. However, do not worry, as we’ll be discussing the most probable actions one might need to take as risk response measures.

Monitoring The Risks

The last stage of the process is monitoring. However, this is one of the most comprehensive parts of the whole deal. You can only expect to see results if you know what is happening.

Therefore, the final and critical element of risk management is monitoring. However, remember that different forms of risk come with their own monitoring challenges. Thus, have clarity and proceed accordingly. You cannot go about fixing cybersecurity issues with operational techniques. Therefore, have clarity and keep observing for the sake of studying and fixing the problem.

Benefits Of Having A Risk Management Strategy

We have already pointed out why you need risk management strategies, and we will eventually start discussing the different types of risk management strategies that are present. But first, let us take a moment and look at some of the benefits of risk management strategies.

- They prevent operational breakdown by keeping the wheels in motion. The job of a risk manager is to identify risks from a mile away and act accordingly. Therefore, they help maintain business continuity.

- There can be different types of risk in risk management. Some include cybersecurity, some include financial, and some include data breaches. A good risk management plan allows businesses to protect their assets. These assets could be physical in nature or non-tangible.

- A company that has the ability to identify risks from a mile away is a company that will keep its customer base happy since there will be less process loss and missing deadlines. Sorry, but we do not make the rules.

Common Responses

Risks can manifest themselves in any form. This is something that you do not have any control over. However, you can have control or say when it comes to responding to the risk. Here are some of the most common forms of risk responses that companies generally engage in:

Avoidance: We all like to avoid our problems in the hopes that they will disappear magically. Howevevr, that rarely works out. Similarly, some businesses choose to go down the same path and wreak havoc on their operation.

Acceptance: The best way to deal with a problem is to acknowledge the problem. You can only find a solution once you accept that there is a real problem. Therefore, this is the more favorable route to go down.

Types Of Risk Management

Finally, it is the time that you have been waiting for. We have studied the fundamentals of business risk management. However, we are yet to get to the meat of things.

Therefore, in this section, we will be talking about some of the most prominent risk management techniques that every business needs to know.

However, just remember that this section is not a ranked section. Therefore, you can approach this section in whichever order you find comfortable.

With that note, let us dive right in!

Type #1

Business experiments are a great way of understanding and studying ‘what-if’ scenarios. These scenarios can be beneficial as they allow businesses to understand what might happen if a particular form of risk approaches.

Therefore, this is one of the best types of risk management as it helps businesses prepare for what is to come. Subsequently, prepare employees when things go horribly wrong. IT and financial departments should use this technique religiously to stay ahead of the curve.

Type #2

The second type of risk management technique is called theory validation. Theory validation presents questionnaires and surveys to employees, who are expected to provide feedback. This is a great way to involve more heads to solve a problem.

This form of risk management is usually used to identify design flaws or equivalents. In other words, these are used to perfect a product or a service and eliminate problems from the mix. Hence, it is a precautionary method.

Type #3

It is straightforward to get carried away while developing a product. They should try to saturate the product with features. Well, this sounds good on paper, but not in real life.

Riddling a product with irrelevant features will only add to your problems and nothing else. Therefore, sit down with a team of core developers and make a list of all the core features that the product needs.

This can simplify the whole task and make things easy for the customers.

Type #4

As a risk manager, your foremost task is to identify and isolate risks. Isolating risks is a critical practice. Think of things like this: there is one guy who is contaminated with a virus.

Do you let him infect others? Or do you contain that guy? The answer is the latter. Containing a problem stops it from spreading. Therefore, it gives you enough time to deal with the problem effectively.

Type #5

The final risk management technique we will discuss is building buffers. Buffers are one of the most reliable types of risk management techniques in existence. Bluffers ensure that the process stays afloat and the problem is dealt with.

Therefore, this is one of the most prominent ways of dealing with a problem, as it does not let problems disrupt the business operation. Just remember that building buffers is a very technical thing to do. Therefore, leave it for the

That Is The End

In the end, these are some of the most prominent types of risk management techniques that you will come across in your career as a risk manager or an entrepreneur. Hence, you need to know how to go around them.

Risk management is one of the only sectors that is constantly evolving. Therefore, take help from this article, but remember to follow your gut. That is the only way to get ahead in this sector.

Additional Reading: