Unique Insurance Company Review

by Abdul Aziz Mondal Insurance Published on: 16 February 2020 Last Updated on: 18 October 2024

One of the largest specialty insurers in the U.S. is a Unique insurance Company. They have grown their customer base for years, using a simple mission, always put the customer first. It also helps that Unique has low rates on auto and homeowners insurance that few competitors can match.

The carrier sells its insurance products through a network of well-qualified insurance agents and brokers. If a potential customer wants a quote for auto, home, life, and health insurance, they have two options. They can go online and fill out a free quote application or call the toll-free number during normal business hours and talk to an agent.

Features Of An Unique Insurance Company

here are the features that will help you in choosing a unique insurance company.

A Solid Reputation Built on Financial Strength:

Unique insurance is a rock-solid company that has maintained the highest ratings from A.M. Best for years. These A+ ratings prove that the company is well managed and maintains careful financial discipline. They also have some of the best ratings on customer service of any insurer and have won numerous industry awards.

Unique Auto Insurance Coverage:

Unique insurance can cover just about any vehicle. This includes standard insurance with low rates on liability, collision, and comprehensive insurance. Customers with a good driving record can qualify for buy now pay later car insurance with deposits that start at just $20.

There’s also coverage available for classic cars, exotic vehicles, and recreational vehicles. If you have automobiles that you keep mostly garaged, Unique can cover them as well, with low rate group coverage. Get a quote today and save hundreds online.

For newer vehicles, most people chose unique comprehensive plans that offer full protection. And for good drivers over the age of 25, plans start at about $100 a month. For those looking for the cheapest rates available, there is Unique dollar day auto insurance with down payments of only $20.

Optional Vehicle Coverage for Less:

Unique also has uninsured motorist coverage at low monthly rates. For those that travel frequently, there is rental car insurance and roadside assistance that adds extra security and peace of mind.

It does not matter whatever vehicle you are running, safety should be your utmost priority. Remember nothing is more expensive than your life. But most of the health insurance schemes does not offer service for accidental issues.

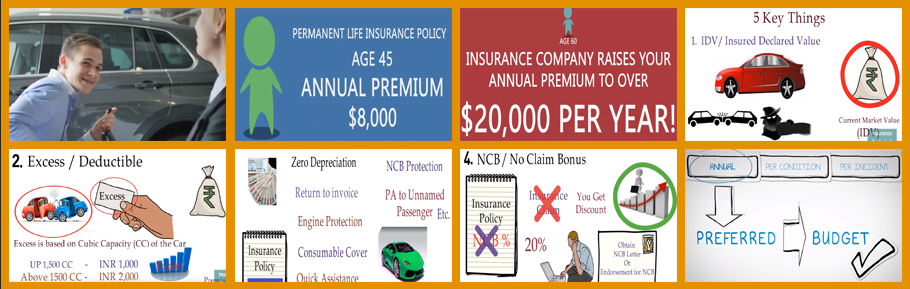

Discounts that can Save you More:

A unique insurance Company has great discounts that can save you some serious money. Here are just a few discounts:

- Safe Driver Discount

- Discounts for drivers who complete a certified safe driver training course

- Good Student Discount

- Bundling auto and homeowners insurance together

- Military and Veteran Discount

- Senior Citizen Discount

To check all the available discounts, call for a free quote and connect with an agent near you.

How Does Car Insurance Work?

On the basis of the insurance coverage that you chose, you either need to pay the premium or set a monthly payments schedule. These payments on a monthly basis are known as installments.

In order to insure your car the amount that you need to pay depends on various things. Such as, the model and make of the car that you own. In case you own a non-standard vehicle, for example, a vintage Corvette Stingray; you need to pay a higher premium.

For activating the insurance policy you have to make a downpayment. In case you are on a tight budget, do not worry about that. You will also get insurers who will offer you insurance with a downpayment of as little as $20. But you need to make the payment before the activation of your insurance.

How Many Coverages Can You Expect?

There are several types of coverage that you will get in the market. But here I will cover four major coverages that are on the popular list of insurance.

- Liability Coverage.

- Medical payments coverage.

- UM or Uninsured Motorist coverage.

- Under insured motorist coverage.

These four different coverages cover different kinds of scenarios. And also have different terms and policies. So, before you select any of these make sure that you are gathering enough information to choose the correct option.

Medical coverages are a huge part that is covered here but not in every case. So, you also need to make sure that as per your convenience or requirements you are eliminating or including the medical coverage.

In order to avail of the facilities or assistance, you also need some documentation. Make sure that you are keeping all the documents in hand while filing the claim. each and every document is equally important. it will be best if you get the idea of the documents before purchasing any insurance.

these documents may include the police report, the medical bills, prescriptions, some photos of the affected place or your injury will also help you here to get your coverage.

Final Takeaway

Unique insurance is a quality insurer that has grown for years due to its solid focus on the customer. The company offers affordable auto and home insurance through experienced agents that have the customer’s best interest in mind. those agents will take good care of your requirements and will assist you throughout the process.

The popular Unique auto insurance has plans for almost all drivers. This includes safe drivers, seniors, and also those motorists that are considered high risk. so, it will be definitely beneficial for you to opt for a plan today.

Some More

They also offer low monthly rates with plans that start at about $30 per month and convenient installment payment options. Their website is easy to use and you can get a quote in about 5 minutes. Overall, a unique insurance company is a good choice for most drivers. Start your free online quote by entering your zip code.

Read Also: